Reeves’ Balancing Act

Walking the tightrope between political promise and fiscal prudence

Britain’s fiscal credibility test begins on… November 26th.

As we get closer to the date above, the speculation on what levers the Chancellor will pull or push is intensifying. Rachel Reeves is trapped in a fiscal doom loop of her own making, and the arithmetic is getting uglier by the day.

The UK economy grew 0.3% in the three months to August which is technically positive, but barely above stalling speed. The Treasury spun this as “fastest growth in the G7 since the start of the year,” which is like celebrating being the tallest dwarf. For most people, the economy doesn’t feel like it’s growing at all. It feels stuck.

The real story isn’t the growth figures. It’s the fiscal black hole opening beneath the Chancellor’s feet.

The Disappearing Headroom

Back in March 2024, the Office for Budget Responsibility (OBR) forecast that Reeves would have £10 billion of headroom against her own fiscal rules by the end of this parliament. That headroom is the buffer between total government spending and the self-imposed limit that public spending must be funded by tax revenues plus a safety margin.

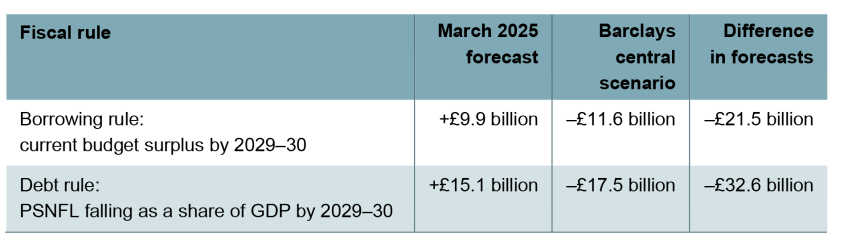

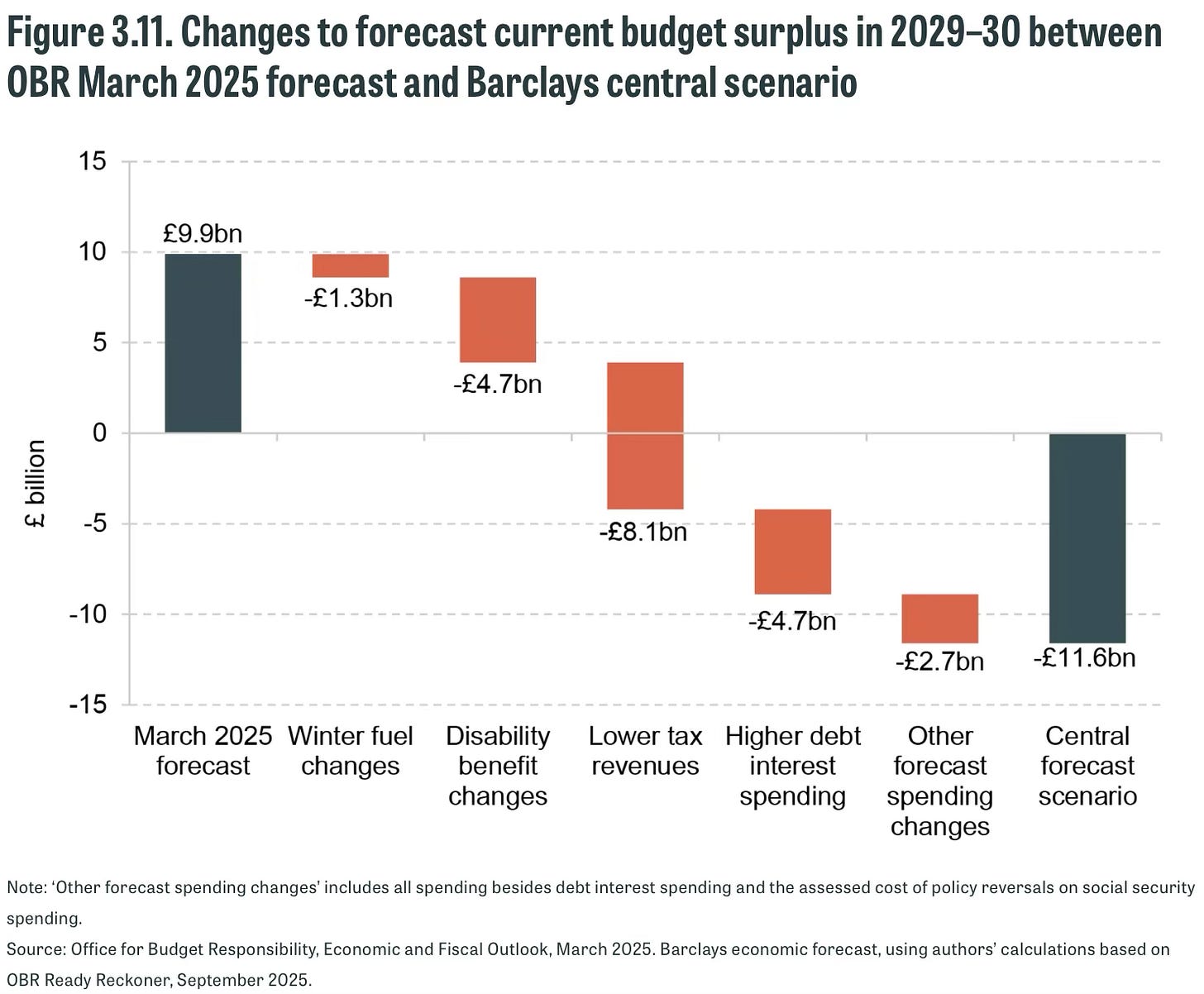

That £10 billion has evaporated. Here’s how, according to Institute for Fiscal Studies (IFS) analysis done with Barclays:

First, welfare reforms got torpedoed (-£6 billion): The government had planned welfare cuts (WFA at £1.3bn + disability benefit changes at £4.7bn). Labour backbenchers revolted. Those savings are gone. Headroom down to £4 billion.

Second, borrowing costs spiked (-£5 billion): Markets smelled weakness after the welfare U-turn. UK gilt yields jumped. When the government looks politically incapable of making hard choices, bond vigilantes charge more to lend. This wiped another £5 billion off the headroom.

Now we’re at -£11 billion. The buffer is gone. But it gets worse.

Third, growth forecasts revised down (-£11 billion): The OBR is expected to downgrade growth projections in November, partly because of the tax rises in Labour’s first budget dampening business investment. Lower growth means lower tax revenues (in this case it’s -£8.1bn for lower tax revenues + -£2.7bn for other forecast spending changes), which blows a £11 billion hole in the projections.

Total damage: -£22 billion black hole.

The £10 billion cushion has become a -£22 billion crater. And the November 26th budget is ever-looming.

The Doom Loop Mechanics

Here’s why this is a doom loop, not just a budget problem:

Politically difficult choices → Market loses confidence

Borrowing costs rise → Fiscal position worsens

Need even more politically difficult choices → Market loses more confidence

Repeat until something breaks

Reeves can’t raise the “big three” taxes (income tax, National Insurance, VAT) because of Labour’s manifesto pledges. I still do think that if she wants to restore fiscal headroom, she’ll have to break Labour’s manifesto pledge. That leaves her scrounging for revenue through:

Fuel duty increases (politically toxic)

Pension tax relief cuts (p****s off middle class)

Capital gains tax hikes (dampens investment further)

Council tax revaluations (electoral suicide in marginal seats)

Further public sector pay freezes (unions revolt)

Every option has nasty second-order effects. Raise business taxes, investment falls. Cut public services more, productivity suffers. Increase borrowing, gilt yields spike further.

The IFS notes the same problem I’ve been banging on about regarding UK economic dysfunction - we’ve created a system where modest economic growth and constrained tax bases mean governments are perpetually broke, regardless of who’s in power.

The “Bold” Alternative

The IFS floats an interesting thought experiment. What if Reeves stopped trying to patch the £22 billion hole and instead aimed for £32 billion in fiscal tightening to restore proper headroom?

The logic here is to go big or go home.

If she announces genuinely tough measures - real spending cuts, meaningful tax rises, structural reforms - the markets might actually reward her with lower borrowing costs. Confidence returns. Gilt yields fall. The virtuous circle replaces the doom loop.

The maths could work:

Find £32 billion through painful measures

Borrowing costs fall by 50-75 basis points (plausible if markets see credibility)

Lower debt servicing costs create fiscal space

Improved growth outlook from policy certainty

Headroom restored, breathing room created

The politics are impossible:

Going for £32 billion means telling voters:

“We’re raising taxes more than we said”

“Public services will be cut deeper than expected”

“The pain will be severe and immediate”

“But trust us, it’ll be worth it in 2028”

Labour MPs would rebel. Unions would strike. The opposition would crucify them. And unlike Liz Truss, who crashed the economy with unfunded tax cuts, Reeves would be crashing her political capital with painful-but-necessary fiscal consolidation.

Economically rational. Politically suicidal.

Why This Matters

This isn’t just Westminster drama. It’s a case study in how fiscal rules become fiscal traps.

Reeves inherited a broken fiscal framework where decades of underinvestment, productivity stagnation, and demographic pressures have left Britain with:

Growth too weak to generate sufficient tax revenue

Public services too degraded to cut further without backlash

A tax base too narrow to fund spending commitments

Political constraints preventing necessary reforms

The fiscal rules she’s trying to meet aren’t the problem; they’re revealing the problem. Britain’s economic model is broken, and no amount of accounting tricks or “tough choices” will fix it without addressing why our capital markets are dysfunctional, why pension fund reforms destroyed productive investment, and why we’ve systematically disincentivized risk-taking.

The Likely Outcome

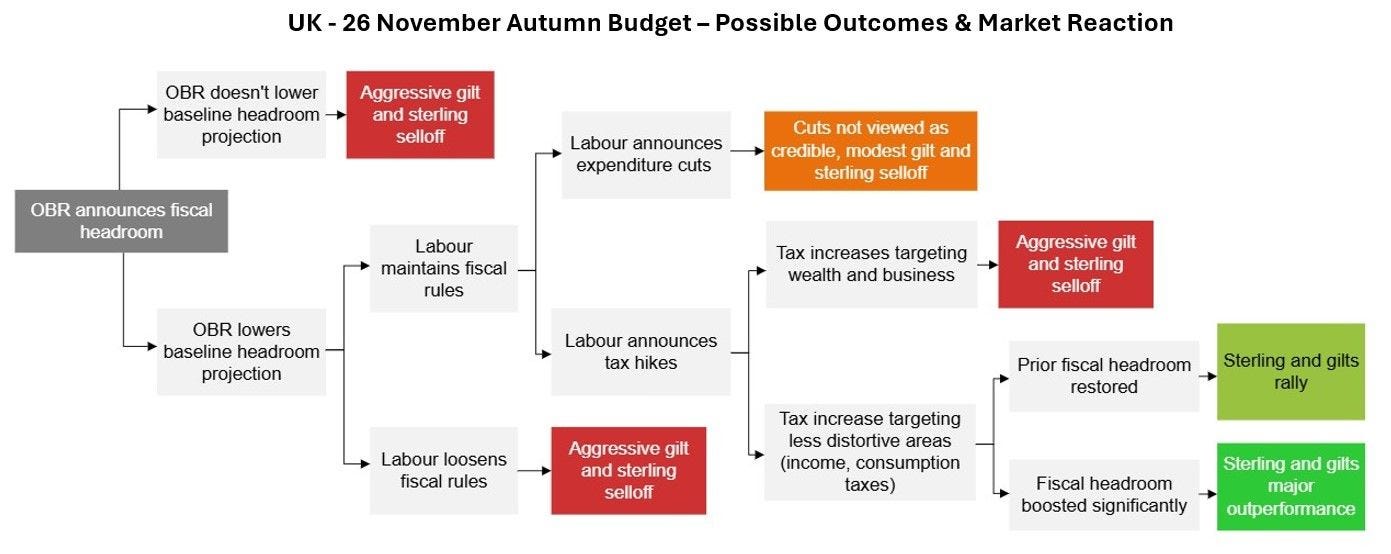

There’s a chart below that explains how markets might react to each possible outcome of the UK’s Autumn Budget on 26 November. Credit to

who took his time to draw out such a succinct display of Rachel Reeves’ budget decisions and what it means for markets.Going into the statement, one thing looks near certain: the OBR will show Labour needs to tighten policy or risk breaching its own fiscal rules.

The most likely route is a round of tax rises - potentially stretching the manifesto line on income tax and VAT - to restore fiscal headroom to roughly £9 billion, where it’s sat for the past two Budgets. That would likely spark a relief rally in gilts and lift one of sterling’s main overhangs. Lower yields don’t usually mix with a stronger pound, but reduced fiscal risk and a flatter curve would make this a textbook move.

The alternative scenarios are less probable and mostly bearish for both gilts and sterling. Any surge in issuance would hit already fragile markets, and spending cuts look implausible given Labour’s failed attempt to legislate even modest welfare savings after the Spring Budget. There’s little left to trim elsewhere.

The only real upside would be a sweeping policy shift that boosts headroom back to around £30 billion - the average from 2010 to 2022 - reducing both fiscal risk and policymaking volatility.

Reeves will probably split the difference:

Find £15-20 billion through hodgepodge measures

Keep some headroom (£3-5 billion)

Avoid the truly catastrophic choices

Hope growth surprises to the upside

Rinse and repeat in 6 months when the numbers deteriorate again

Oh, and also refuse to stand by their manifesto tax pledge - in other words, income tax will go up.

This is the path of least resistance. It’s also the path of continued mediocrity.

The doom loop continues. Borrowing costs stay elevated. Growth disappoints. The next budget faces the same choices. Britain muddles through, getting slowly poorer relative to competitors who made hard choices decades ago.

The November 26th budget will reveal whether Reeves has the courage to break the cycle or the political instincts to manage decline gracefully.

Based on the evidence so far, I’m betting on the latter.

But, what do you think? Share your thoughts below 👇

I’ll write a (longer) sequel to this post in December on my personal Substack titled ‘Damage Control’ that dives into the specifics of the UK budget and its implications for financial markets, the economy and UK residents.

For more on why Britain’s economic model is broken and what it would actually take to fix it, see my UK Capital Markets series: Part 1, Part 2, Part 3, Part 4, Part 5.

Sources:

Good roundup, thanks for sharing my work :)

She will go for the line of least resistance as described above. As you’ve indicated there are other options but they are not palatable to a party that does not believe in wealth creation (as it’s basically a means to fund the public sector rather than an objective in and of itself). There are a few novel factors that have to be considered including increasing defence costs and increasing spend on new drugs (to keep POTUS on side).